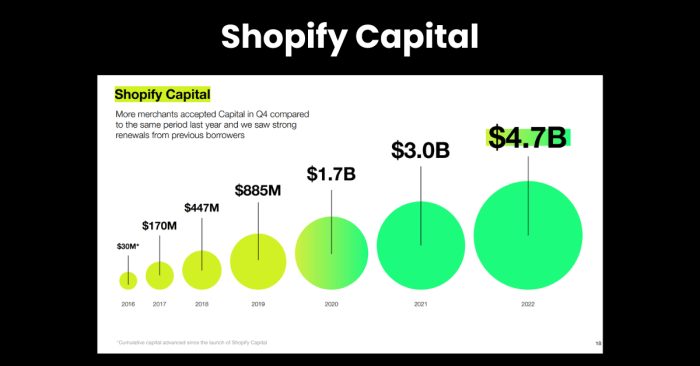

Diving into the realm of Shopify Capital Loan Explained: Pros, Cons & Best Practices, this introduction sets the stage for an insightful exploration of this financial tool that can transform businesses.

In the following paragraphs, we will delve deeper into the mechanics and benefits of Shopify Capital Loan for businesses looking to expand and thrive.

Introduction to Shopify Capital Loan

Shopify Capital Loan is a financing option provided by Shopify to help businesses access the funds they need to grow and expand. Unlike traditional loans, Shopify Capital Loan does not require a credit check or extensive paperwork, making it a more accessible option for small businesses.

Eligibility Criteria for Shopify Capital Loan

- Must have a Shopify store and be based in a supported country

- Minimum sales threshold on Shopify platform

- Good payment history and account health on Shopify

Examples of Shopify Capital Loan Benefits

Many businesses have used Shopify Capital Loan to invest in inventory, marketing campaigns, and store improvements. This injection of capital has helped them increase sales, launch new products, and reach a wider audience, ultimately driving business growth.

Pros of Shopify Capital Loan

When it comes to considering a Shopify Capital Loan for your business, there are several advantages that set it apart from traditional loans. Let's explore some of the key benefits below:

Flexibility in Repayment Options

One of the major pros of a Shopify Capital Loan is the flexibility it offers in terms of repayment options. Unlike traditional loans with fixed monthly payments, Shopify Capital Loans allow businesses to repay the loan based on a percentage of their daily sales.

This means that during slower months, businesses are not burdened with high fixed payments, making it easier to manage cash flow effectively.

Improved Cash Flow Management

Another advantage of choosing a Shopify Capital Loan is its ability to help businesses with cash flow management. By providing access to quick funding, businesses can address immediate financial needs, invest in growth opportunities, and manage day-to-day expenses more effectively.

This can be especially beneficial for businesses looking to expand or navigate seasonal fluctuations in revenue.

Cons of Shopify Capital Loan

When considering a Shopify Capital Loan, it is essential to weigh the drawbacks and potential risks associated with this financing option. Below are some key considerations to keep in mind:

1. Limited Loan Amounts

While Shopify Capital Loans can be convenient for small businesses, the loan amounts offered may not be sufficient for larger enterprises or those in need of substantial capital.

2. Fixed Repayment Structure

One of the potential drawbacks of a Shopify Capital Loan is the fixed repayment structure. This means that you will need to make regular payments, regardless of your business's cash flow or financial situation.

3. Higher Interest Rates

Compared to traditional bank loans or other financing options, Shopify Capital Loans may come with higher interest rates. It is essential to compare the rates with other lenders to ensure you are getting the best deal.

4. Impact on Cash Flow

Taking out a loan through Shopify Capital can impact your business's cash flow, especially if you are required to make fixed payments. This can put a strain on your finances and limit your ability to invest in other areas of your business.

5. Risk of Default

Just like any other loan, there is always a risk of default when taking out a Shopify Capital Loan. If you are unable to make the payments, it can have a negative impact on your credit score and business's financial health.

Best Practices for Utilizing Shopify Capital Loan

When it comes to making the most of a Shopify Capital Loan, there are several best practices that businesses can follow to ensure success. By strategically investing the loan amount and planning finances wisely, businesses can leverage this funding opportunity to drive growth and achieve their goals.

Strategies for Effective Utilization of Loan Amount

- Identify areas of your business that need immediate financial support, such as inventory management, marketing campaigns, or technology upgrades.

- Allocate the loan amount strategically to maximize impact and address key areas for growth within your business.

- Consider investing in marketing and advertising efforts to attract new customers and increase sales.

- Explore opportunities to expand your product line or improve existing offerings to stay competitive in the market.

Importance of Proper Financial Planning

Proper financial planning is crucial when utilizing funds from a Shopify Capital Loan. It is essential to:

- Develop a clear budget and financial roadmap to ensure that the loan amount is used effectively and efficiently.

- Monitor your cash flow regularly to track the impact of the loan on your business finances.

- Set specific goals and milestones for your business growth to measure the success of your investment.

- Work with financial advisors or consultants to create a sound financial strategy that aligns with your business objectives.

End of Discussion

In conclusion, Shopify Capital Loan emerges as a valuable resource for businesses seeking financial assistance with a twist of flexibility and growth potential.

FAQ Compilation

What are the eligibility criteria for a Shopify Capital Loan?

Businesses need to have a minimum of 1 year in business, process a minimum of $15,000 in annual revenue, and use Shopify Payments for their store.

What are the risks associated with taking a loan through Shopify Capital?

One potential risk is that if your business underperforms, you may still need to repay the loan based on your sales.

How does Shopify Capital Loan help with cash flow management?

It provides a lump sum of cash upfront, allowing businesses to invest in inventory, marketing, or other growth opportunities without impacting their cash flow.