Kicking off with Shopify Capital Loan: Everything You Need to Know, this opening paragraph aims to captivate and engage the readers by providing a comprehensive overview of what this financial option entails for e-commerce businesses.

Exploring the ins and outs of Shopify Capital Loan, this article delves into the application process, loan terms, impact on businesses, and more, offering valuable insights for those considering this avenue of funding.

Introduction to Shopify Capital Loan

Shopify Capital Loan is a financing option offered by Shopify to eligible e-commerce businesses. It provides merchants with a lump sum of capital that can be used to grow and expand their online stores.

Eligibility Criteria

- Active Shopify store for at least 6 months

- Minimum monthly revenue threshold

- Positive cash flow

Benefits of Shopify Capital Loan

- Quick and easy application process

- No fixed monthly payments

- Funding tailored to your business needs

- No personal guarantee required

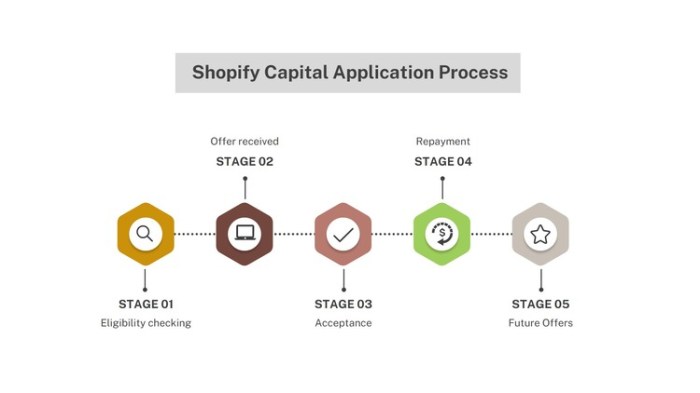

Application Process

Applying for a Shopify Capital Loan is a straightforward process designed to help merchants access funds quickly and easily. Here is a step-by-step guide to the application process, along with details on documentation required and the time frame for approval and disbursement of funds.

Step-by-Step Process

- Create a Shopify account and ensure your store meets the eligibility criteria for a Shopify Capital Loan.

- Access the Capital section in your Shopify dashboard and click on 'Check Eligibility' to see if you qualify for a loan.

- Submit the application form with details about your business, revenue, and loan amount requested.

- Review and accept the loan offer if approved, then complete the final steps for disbursement of funds.

Documentation Required

- Business details, including name, address, and contact information.

- Financial statements or reports to demonstrate revenue and sales history.

- Information on the loan amount requested and the purpose of the funds.

Approval and Disbursement Timeline

- Approval for a Shopify Capital Loan can be as quick as 1-2 business days after submitting your application.

- Once approved, funds are typically disbursed directly into your bank account within 2-5 business days.

- Keep an eye on your email for updates and notifications regarding the status of your loan application.

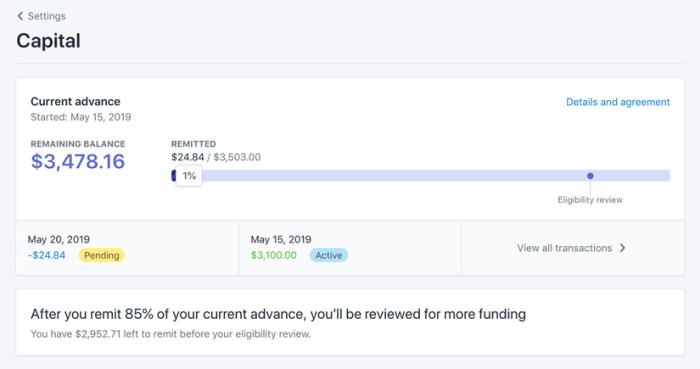

Loan Terms and Repayment

When it comes to Shopify Capital Loans, understanding the loan terms and repayment options is crucial for making informed decisions about financing your business.

Different Loan Terms

- Fixed Amount: Shopify offers fixed loan amounts with a one-time upfront cost.

- Percentage of Daily Sales: You can also choose a loan based on a percentage of your daily sales.

Repayment Options

- Automatic Repayment: Repayments are automatically deducted from your daily sales on Shopify until the loan is fully paid off.

- Early Repayment: You have the flexibility to pay off the loan early without incurring any penalties.

Additional Fees and Charges

- One-Time Fee: Shopify Capital Loans come with a one-time fixed fee that is disclosed upfront.

- No Hidden Charges: There are no hidden fees or charges associated with Shopify Capital Loans.

Impact on Business

When it comes to the impact of Shopify Capital Loans on businesses, there are various aspects to consider. From success stories to potential risks, let's delve into how this financial support can influence the growth and development of a business.

Success Stories

Many businesses have benefited from Shopify Capital Loans, using the funds to expand their product lines, upgrade their websites, or invest in marketing campaigns. For example, a small boutique clothing store was able to increase their inventory and reach a wider audience thanks to a Shopify Capital Loan, leading to a significant boost in sales.

How Shopify Capital Loans Help Businesses Grow

- Provide quick access to funds without the need for extensive paperwork or credit checks.

- Allow businesses to invest in growth opportunities such as launching new products or expanding marketing efforts.

- Help businesses manage cash flow during slow periods or unexpected expenses.

- Enable businesses to stay competitive in the market by adapting to changing consumer demands.

Potential Risks or Drawbacks

- Interest rates on Shopify Capital Loans may be higher compared to traditional bank loans.

- Defaulting on loan payments could negatively impact the credit score of the business owner.

- Businesses may become reliant on loans to cover operational expenses, leading to a cycle of debt.

- If the business does not experience the expected growth, repaying the loan could become challenging.

Wrap-Up

Concluding with a summary of key points discussed, this outro paragraph wraps up the discussion on Shopify Capital Loan, leaving readers with a clear understanding of its benefits, application process, and potential impact on their business growth.

FAQ Insights

What are the eligibility criteria for a Shopify Capital Loan?

To be eligible, merchants must have a Shopify store, meet certain sales thresholds, and have a positive track record with Shopify.

What is the typical time frame for approval and disbursement of funds?

Approval for a Shopify Capital Loan can be quick, sometimes within a few days, with funds typically disbursed shortly after approval.

Are there any hidden fees or charges associated with a Shopify Capital Loan?

Shopify Capital Loans do not have any hidden fees or charges, offering transparent terms for merchants.