Embarking on the journey of securing a Shopify Capital Loan opens up a world of possibilities for businesses looking to expand and thrive. From understanding the nuances of these loans to navigating the application process, this guide will equip you with the knowledge needed to successfully obtain funding for your venture.

As we delve deeper into the intricacies of Shopify Capital Loans, you'll gain valuable insights on how to position your business for approval and maximize your chances of success in this financial endeavor.

Understanding Shopify Capital Loans

Shopify Capital Loans are a financing option offered by Shopify to eligible businesses using their platform. Unlike traditional loans from banks or financial institutions, Shopify Capital Loans are specifically designed for Shopify merchants, making the application process more streamlined and accessible.

Eligibility Criteria for Shopify Capital Loans

- Active Shopify account with a minimum sales history

- Demonstrated revenue and sales growth over time

- Located in a supported country

- Compliance with Shopify's terms of service

Benefits of Shopify Capital Loans

- Quick and easy application process

- No fixed monthly payments, repayment is based on a percentage of daily sales

- Funding can be used for various business purposes, such as inventory restocking, marketing campaigns, or expansion

- Opportunity for businesses to access capital that may not qualify for traditional loans

How to Prepare for a Shopify Capital Loan

Securing a Shopify Capital Loan can be a great opportunity for your business to grow and expand. To increase your chances of approval, it is essential to take certain steps and ensure your financial readiness.

Importance of a Solid Financial Track Record

Having a solid financial track record is crucial when applying for a Shopify Capital Loan. Lenders will review your past financial performance to assess your ability to repay the loan. Make sure to maintain accurate financial records and demonstrate consistent revenue growth to showcase your business's stability.

Tips for Improving Credit Scores

- Pay your bills on time: Timely payments are essential for building a positive credit history. Set up reminders or automatic payments to avoid missing deadlines.

- Reduce credit utilization: Keep your credit card balances low relative to your credit limits. High credit utilization can negatively impact your credit score.

- Monitor your credit report: Regularly check your credit report for errors or discrepancies that could affect your score. Dispute any inaccuracies to maintain an accurate credit profile.

- Diversify your credit mix: Having a mix of credit types, such as credit cards, loans, and mortgages, can demonstrate responsible credit management and improve your credit score.

- Avoid opening new credit accounts: Opening multiple new credit accounts within a short period can signal financial distress to lenders. Limit new credit applications to maintain a stable credit profile.

Applying for a Shopify Capital Loan

When applying for a Shopify Capital Loan, it's essential to understand the process, required documents, and the timeline for approval and funding.

Application Process

- Log in to your Shopify account and navigate to the Capital tab.

- Click on "Apply Now" and fill out the application form with accurate information about your business.

- Review the terms and conditions before submitting the application.

Checklist of Required Documents

- Business bank statements from the last 3 to 6 months.

- Revenue statements to show your business's monthly income.

- Personal identification documents such as a driver's license or passport.

- Business tax returns for the previous year.

Timeline for Approval and Funding

- After submitting your application, Shopify typically reviews it within a few business days.

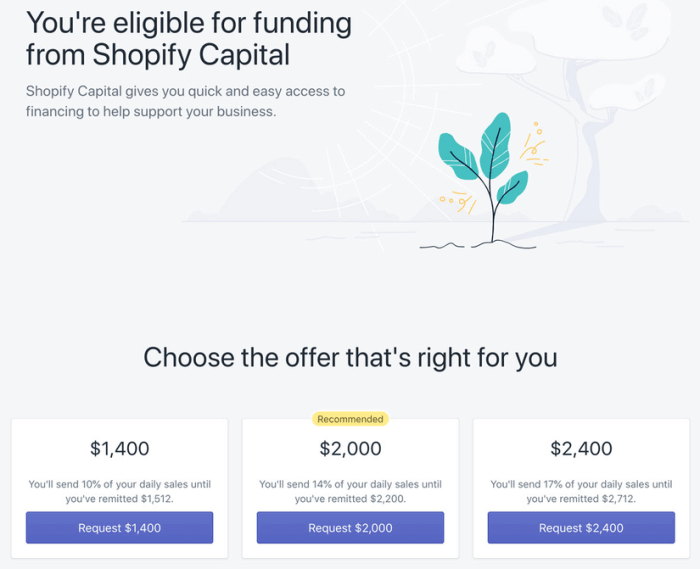

- If approved, you will receive an offer with details on the loan amount, terms, and repayment schedule.

- Funding is usually disbursed within 2 to 5 business days after accepting the offer.

Maximizing Approval Chances

When applying for a Shopify Capital Loan, it's crucial to showcase a strong business plan to lenders. This demonstrates your vision, strategy, and the potential for growth of your business. In addition, highlighting your revenue and sales history, as well as your ability to repay the loan, can significantly increase your chances of approval.

Strategies for a Strong Business Plan

- Clearly Artikel your business goals, target market, and competitive advantage.

- Provide detailed financial projections and metrics to show the potential return on investment.

- Showcase your marketing strategies and how you plan to use the loan to grow your business.

Significance of Revenue and Sales History

- Provide a solid track record of consistent revenue and sales growth to demonstrate the financial health of your business.

- Highlight any significant milestones or achievements that showcase your business's success and potential for future growth.

- Be prepared to explain any fluctuations in revenue or sales and how you plan to address them in the future.

Demonstrating Ability to Repay the Loan

- Clearly Artikel your current cash flow and how the loan will help improve it.

- Show evidence of your ability to repay the loan by providing financial statements, profit margins, and cash reserves.

- Highlight any collateral or assets that can serve as security for the loan, if applicable.

Last Word

In conclusion, securing a Shopify Capital Loan can be a game-changer for your business, propelling you towards growth and success. By following the steps Artikeld in this guide, you can confidently navigate the loan application process and pave the way for a brighter future for your enterprise.

FAQ Explained

What sets Shopify Capital Loans apart from traditional loans?

Shopify Capital Loans offer a streamlined application process and are based on a business's sales history on the Shopify platform, rather than traditional credit checks.

How can a business improve its chances of approval for a Shopify Capital Loan?

Businesses can enhance their approval chances by maintaining a strong financial track record, improving credit scores, and showcasing a solid business plan.

What documents are typically required when applying for a Shopify Capital Loan?

Commonly required documents include bank statements, tax returns, and sales reports to demonstrate financial stability and eligibility for the loan.

How long does it usually take to get approved for a Shopify Capital Loan?

The approval and funding timeline for a Shopify Capital Loan can vary but typically ranges from a few days to a couple of weeks, depending on the completeness of the application.